Considering its well-known fluctuations, cryptocurrency is booming, and many traders are hoping to cash in on the trend. Savvy investors are also speculating on cryptocurrency for years. So,.it is time for you to discover more about Crypto 101, and act safe in the trading environment.

1. Crypto 101: What is cryptocurrency?

Cryptocurrency, also referred to as "crypto," refers to any decentralized, digital money based on encryption. To understand that, you must realize that there are the so-called flat currencies such as:

- Dollar;

- Euro;

- Yen, and other ones.

Decentralized means that, differently from these, cryptocurrency is not controlled by an institution or other central authority – for example: a government or bank.

Despite some cases, the value of most crypto is neither credited to a fiat currency such as the mentioned above, nor by a precious metal such as silver or gold.

Even though some people refer to crypto in tangible terms (such as coins), crypto is created and distributed digitally. The majority of cryptocurrency transactions is stored on a blockchain network, which is a kind of digital ledger.

With the debut of Bitcoin in 2009, the usage of distributed ledgers as the basis for cryptocurrencies had begun.

2. Crypto 101: How does cryptocurrency work?

Virtual currencies are established on a blockchain. This is a decentralized public ledger that contains the values and is up to date by currency bearers.

Mining requires using computational power to resolve complicated math calculations in order to earn coins. Users may also buy the coins from traders, something that they can then keep in encrypted wallets.

If you own bitcoin, you don't own anything tangible. You have a key that allows you to move data or a reference from one user to another without the use of a trusted third party.

3. Crypto 101: What is blockchain?

Blockchain technology became extensively employed as the basic foundation for most sorts of crypto in 2009. Since an interesting application of blockchain allowed the successful operation of Bitcoin. As a result, many people mistake blockchain for bitcoin, despite the fact that blockchain technology has several applications.

Blockchain is essentially an append-only ledger that may be used to track or record almost any type of asset. For instance, products, services, trademarks, smart contracts, and more.

This is possible due to the fact that the system is made up of blocks of data that are linked chronologically (thus the term blockchain). All operations are visible to anyone on the group, and blockchain records are theoretically unchangeable.

In blockchain technology, cryptography is used to protect information. In the case of many types of cryptocurrencies, mine coins, and tokens. A blockchain is made up of nodes, which are decentralized computers that allow consensus (peer-to-peer) validation, allowing for fast and reliable transactions. The validation can happen by different methods: proof of work and proof of stake.

Both proofs of stake and proof of work are two different validation methods and they reward verifiers. Adding bitcoin before transactions are added to the blockchain. To verify transactions, most cryptocurrencies employ these methods of validation. Each computer, referred to as a "miner," solves a problem.

It assists in the verification of a block of transactions, which is then incorporated into the blockchain ledger. The rush to solve blockchain challenges might consume a lot of hardware performance and power.

Proof of work is a way of certifying activities on a blockchain by giving computers a mathematical equation to solve. Every prospector computer solves an equation to help with the certifying of a transaction, which is then put to the blockchain. The race to tackle blockchain problems might use a lot of computing power. Miners may be capable of breaking even with the coin they are mining after factoring in the price of power and computer resources.

4. Crypto 101: What is crypto mining?

Crypto mining is a process of launching bitcoin units into the market as a result for transaction confirmation. While it is an alternative that the average person practice bitcoin mining, this process is getting increasingly difficult with proof-of-work systems.

It is important to remember that processing Proof of Work bitcoin consumes a lot of electric energy, which is not truly a sustainable activity. According to studies, bitcoin farming consumes at least 0.21 % of the world's power.

Also, according to specialists, most Bitcoin miners spend 60% to 80% percent of their revenue on power.

While mining cryptocurrency under a proof of work system is impossible for the average person, the proof of stake approach does not.

5. Crypto 101: What are crypto exchanges?

Trading crypto on a traditional market is almost difficult, apart from new crypto-based securities. That is why some individuals seek a crypto exchange. Currently, there are some different crypto exchanges: hybrid, centralized and decentralized.

Whilst centralized platforms are now the most common way to trade cryptocurrencies, decentralized exchanges are becoming more popular. It is, however, critical to understanding the differences between the three so that you can select the best solution for you.

A centralized marketplace is a platform that allows users to buy and sell cryptos with the help of a third party. You may trade crypto as well as regular or fiat money like the dollar.

Decentralized exchanges (DEX) are more in line with the soul of cryptocurrency. Since they permit crypto traders to negotiate in a straight line with one another without the need of a middleman. Because there is no central platform that may be hacked, a DEX may be more secure in principle.

Hybrid exchanges are less known in comparison to the concepts of decentralized or even centralized exchanges. They strive to mix the best of both ideas, for instance, the fluidness of a centralized exchange with the protection and discretion of DEX.

6. Are Crypto legit?

Stick to the facts rather than the hype when you are thinking of investing in cryptocurrency. In the market, there is a lot of excitement.

Before you acquire or trade digital money, educate yourself on the risks. So you can evaluate whether or not it's a worthwhile option for you and your money. Almost every government and financial authority in the world has warned investors about the risks of investing in cryptocurrencies.

When an investment surfaces in headlines or via advertising and promotion as a way to make money, investors rush in without understanding the risks. One of bitcoin's distinctive traits is its tremendous volatility. You may make big money, or you could lose it all.

Cryptocurrencies companies may be embellishing the amount of money that can be made by dealing with cryptocurrency simultaneously downplaying the risks.

While the government almost always protects bank deposits, this is not always true with bitcoin investments. If a crypto exchange goes bankrupt, there's no guarantee you will receive your money back.

7. Where to find trustful crypto 101 alerts?

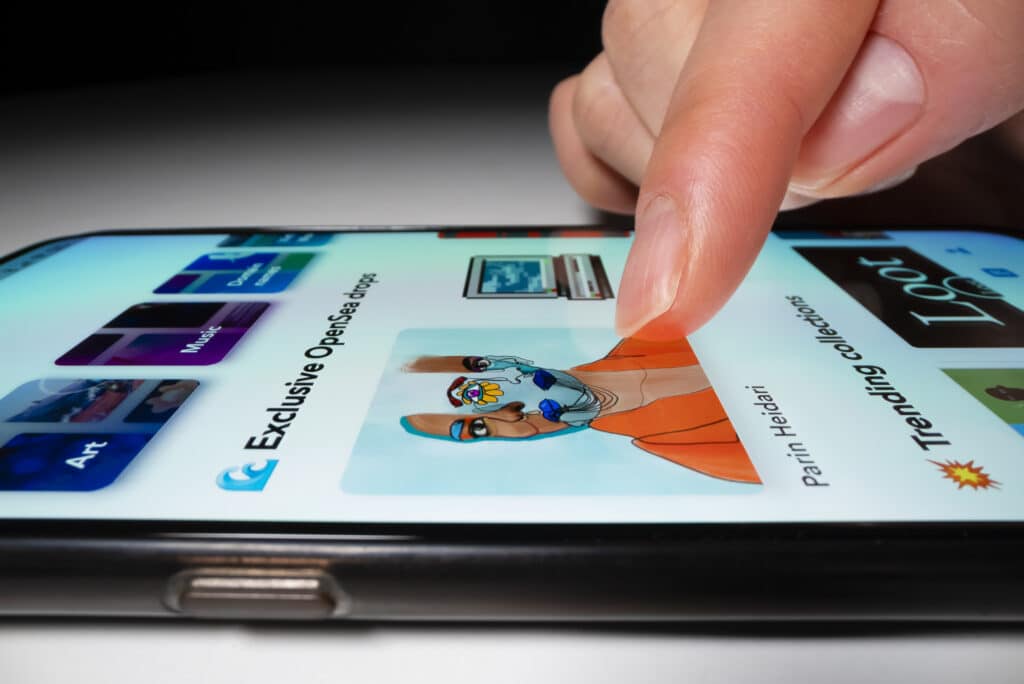

When dealing with crypto markets, one of the main factors to consider is timing. Crypto coin alerts, which arrive as an instant message on your mobile, are one of the greatest cryptocurrency trading tools. Fat Pig Signals offer alerts to its clients. There are a few different sorts of alerts that might help you get an advantage.

The post Crypto 101: how to start investing appeared first on Fat Pig Signals.

https://ift.tt/tVDadQs