Layer 1 Crypto Trading Opportunities

Although Blockchain technology offers great utility in many segments, such as defi, medical, supply chain and games, it’s hard for them not to face scalability issues if the demand for the network increases significantly. That’s when layer 1 and layer 2 solutions come in useful.

With the increased demand for this solutions, the value of many crypto tokens from this layers have seen some exponentially appreciation, rewarding those who recognized the potential early on.

Therefore, over the past year the market gave us a bunch of crypto signals in the segment. Members of the Fat Pig Signals Vip service have noticed a trading signal surge regarding Layer 1 and Layer 2 tokens, bringing good profits for those who followed.

Understanding the basics

Layer 1 blockchains have seen significant growth as more people around the world see value in the decentralization and security they provide.

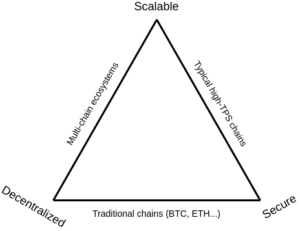

The problem that surges, was described by Vitalik Buterin as the scalability trilemma, where you can only achieve 2 of the 3 properties (Scalability, Decentralization, Security) if using “simple” techniques.

As previously mentioned about Blockchains, one major problem regarding most of them is the bottleneck to scaling.

Layer 1 solution refers to improving the underlying blockchain itself and this technology operates on-chain, where all the functionalities are processed on the main chain, differently from Layer 2, which operates over the native layer.

The main Layer 1 solutions today are the consensus protocol changes and sharding. We will give you an overview on what they are.

Consensus

The consensus mechanism verifies whether the data should be added to the blockchain record. For that, all or the majority of the participants' nodes must agree.

For instance, bitcoin uses the consensus protocol Proof-of-work, where the block mining confirms the transactions. This mechanism is fairly secure and decentralized, but can come across speed issues.

Common types of consensus mechanisms:

Proof-of-Work (PoW): The traditional consensus used in Bitcoin and Ethereum, it intends to achieve consensus and security using physical miners to decode complex algorithms and the main issues faced in a PoW model is that it uses a lot of resources and can be slow given high network demand.

Proof-of-Stake (PoS): This mechanism aims to authenticate block transactions based on the users stake on the network, it has a higher transaction speed than PoW, but is less secure in a sense.

Delegated Proof-of-Stake (DPoS): It's essentially a variation of PoS, but instead of the selection process being randomised, it allows stakers to vote on the validators and the key downside is that it may incur in a potential centralization.

Those mechanisms are still subject to bottlenecking if the number of users increases heavily. One viable solution is to scale through sharding.

Sharding

This solution consists of breaking transactions into smaller data sets, known as shards, enabling them to be processed by the network in parallel. This approach allows blockchains for great scalability. Sharding is present in blockchains like NEAR and should also come towards the Ethereum network in the future.

Riding the wave and catching crypto signals & opportunities

So, the technology is great indeed, but how can you benefit from it, besides the use cases on your daily routine?

If you are looking to speculate on the project token appreciation, you might do your own research and keep track of the market at all times, since the market conditions could change quite fast, as new projects and ideas come to the crypto space, what was once considered a great fundamentally driven project, can become less interesting/outdated.

In order to make the most value from it, you need to gather information from high quality sources and essentially know how to trade.

Knowing the fundamentals of crypto projects and combining it with good Technical Analysis, can help you perform well in the crypto market, therefore, if you don’t have enough experience, it might be worth sticking around people that have, so you can learn and improve yourself.

Fat Pig Signals Vip service provides intel about the cryptocurrency market:

- Crypto Signal.

- Portfolio Strategy.

- Yield Farming Strategy.

- Market Analysis.

- Altcoins Research.

Some examples of Layer 1 crypto signals that our Vip members were able to make profits on.

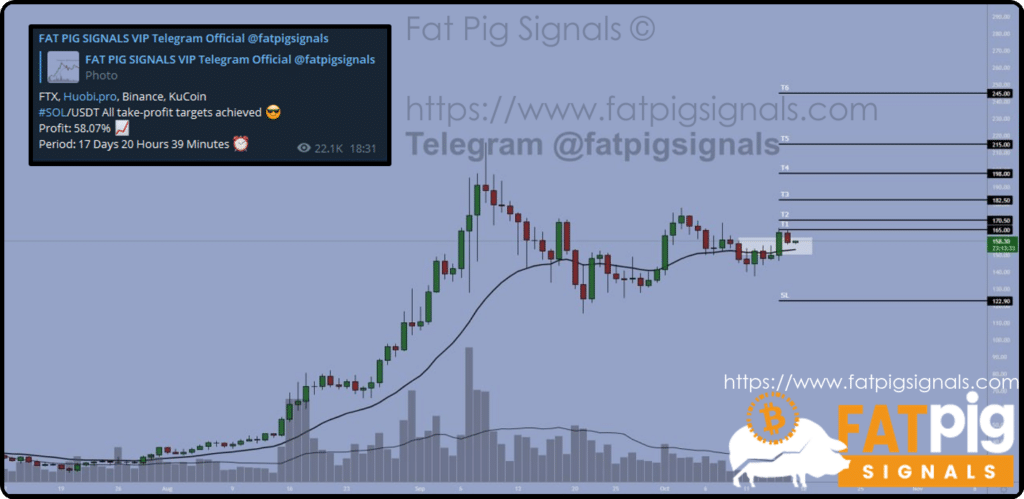

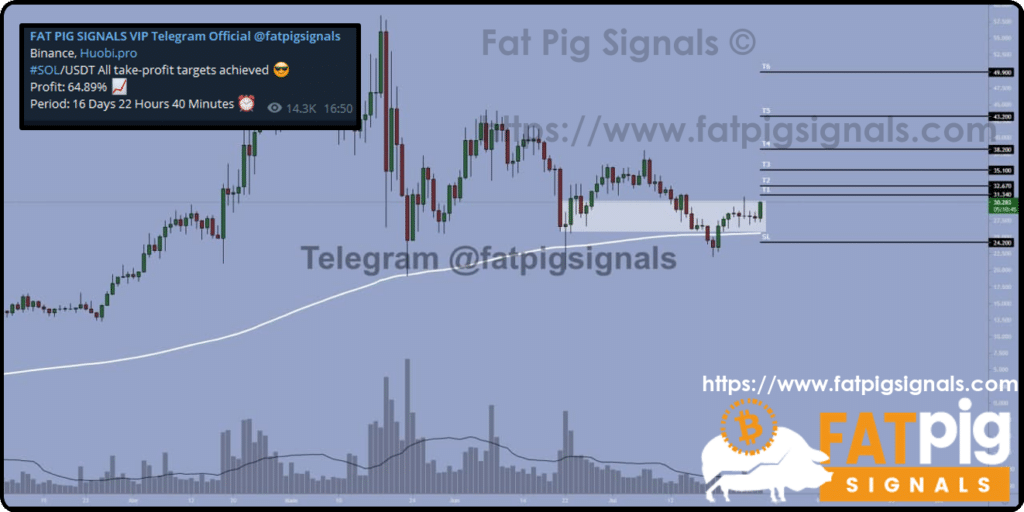

Solana Signal (SOL):

SOL/USDT Crypto Signal

SOL/USDT Crypto Signal

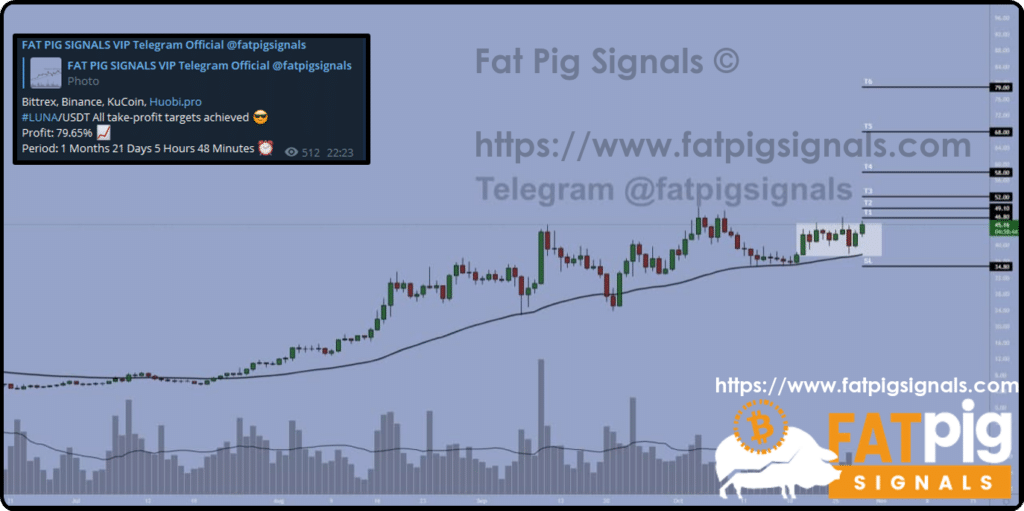

Terra Signal (LUNA):

LUNA/USDT Crypto Signal

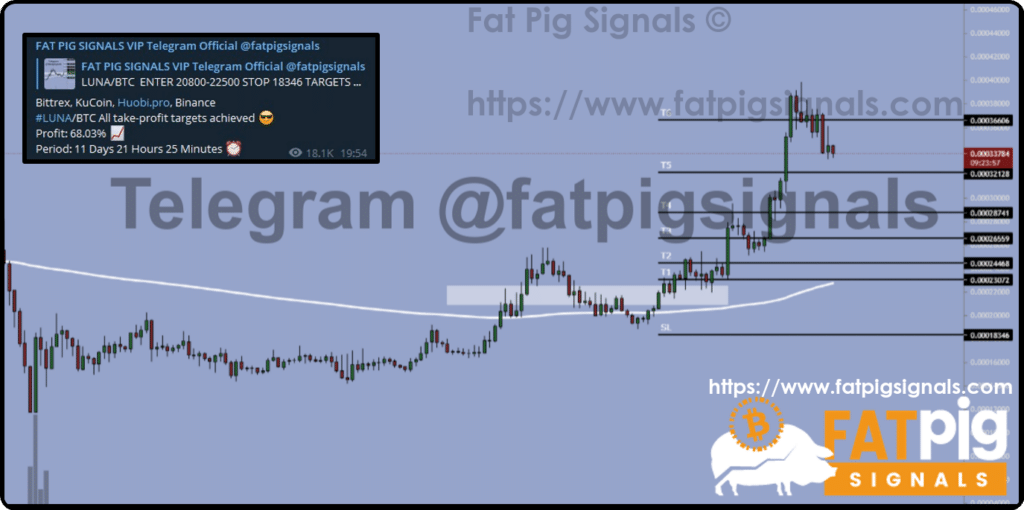

LUNA/BTC Crypto Signal

Avalanche Signal (AVAX):

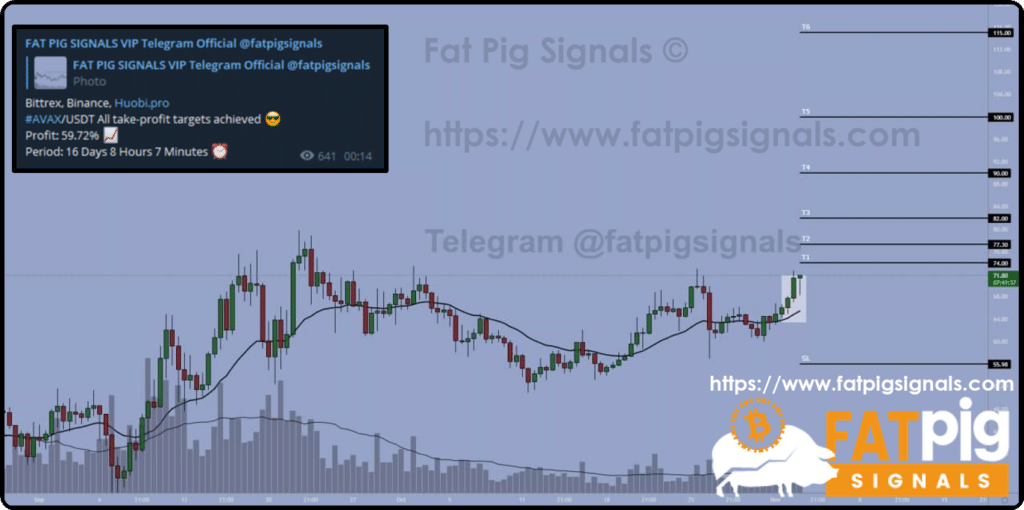

AVAX/USDT Crypto Signal

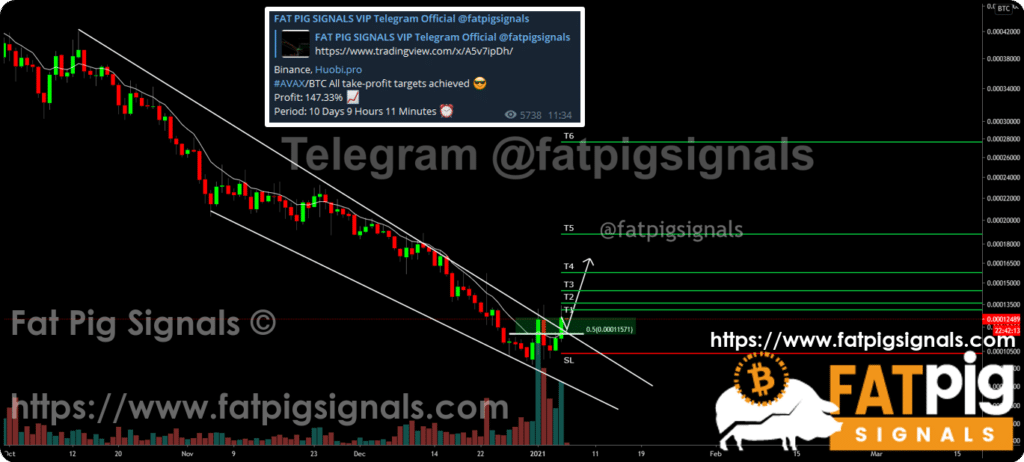

AVAX/BTC Crypto Signal

Harmony Signal (ONE):

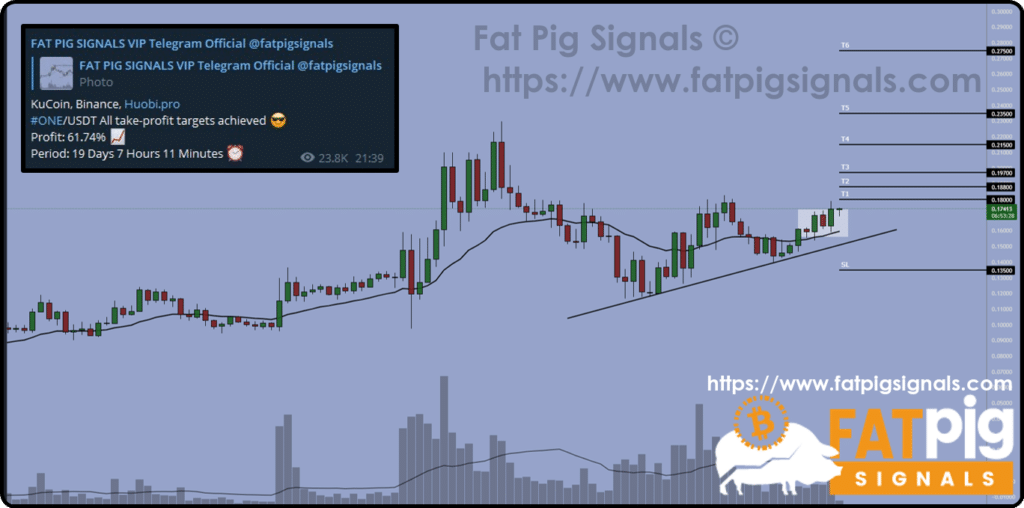

ONE/USDT Crypto Signal

ONE/BTC Crypto Signal

The cryptocurrency market rewards those who have patience, stick around for the long term and do the required research.

Having exposure in projects based purely on fundamentals is usually not the best approach, since they could take time to catch stream.

As a matter of fact, combining good trading skills with fundamental and technical analysis as well as market sentiment is what brings you the most value.

Innovation in the crypto market moves quite rapidly and can be hard to keep track only on your own, our crypto signal service can provide great value, helping to catch strong trends and new opportunities early on.

The post Crypto Signals & Layer 1 Basics appeared first on Fat Pig Bitcoin & Altcoin Signals.

https://ift.tt/3A3AKQ3

Nenhum comentário:

Postar um comentário